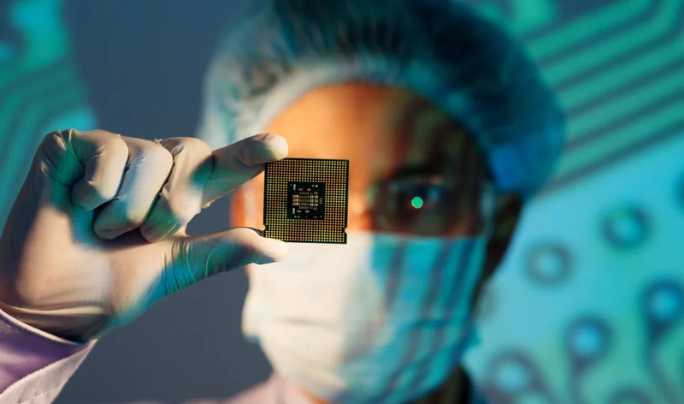

Custom BFSI solutions built for performance, security, and compliance

We develop bespoke solutions that ease operations and empower your customers with fast, reliable, and safe access to financial services.

I'd Like To Know More!

Simform’s capabilities

Banking solutions

Optimize core banking operations, from account opening to reconciliations and fraud prevention.

We implement advanced ML algorithms for fraud detection, digital customer onboarding solutions with e-KYC capabilities, NLP-powered intelligent virtual assistants, and Open Banking API integrations for secure exchanges.

InsurTech solutions

Streamline underwriting, claims, policy management, and customer service for faster turnaround times.

We engineer solutions such as automated claims processing systems using computer vision and ML models, digital insurance aggregators with real-time data analytics, usage-based insurance apps with IoT, and CRM integrations for personalized experiences.

Payments systems

Enable seamless, secure, and instant payments with transactions completed within 200ms on average.

We craft contactless payment solutions with NFC technology, voice-enabled smart wallet with BLE integration and GATT profile setup for secure connection, and invoicing management platform integrating ERPs like QuickBooks, Xero, and Sage.

P2P lending and mortgage tech

Expedite the entire loan lifecycle with loan management solutions, DMS like DocuSign, automated credit scoring and risk assessment with ML tools like TensorFlow.

We develop peer-to-peer lending platforms powered by collaborative filtering algorithms, mortgage automation systems employing rule-based engines, buy-now-pay-later apps, and crowdfunding platforms.

Wealth management solutions

Develop robust digital solutions for investment management, portfolio tracking, risk management, and personalized financial advice.

We build robo-advisors to automate investment strategies, portfolio optimization algorithms like Markowitz, stock market sentiment analysis using algorithms like squarified treemapping, and robust data engineering pipelines for auditing.

Next-gen fintech solutions

Modernize operations and reduce costs with advanced technologies like Robotic Process Automation (RPA) to automate repetitive tasks or blockchain DeFi solutions.

We help you deploy emerging tech, such as RegTech solutions like KYC/AML compliance platforms and regulatory reporting automation, cryptocurrency payment solutions, and more.

Your edge in BFSI innovation

Simform has comprehensive engineering experience that spans across diverse segments of the financial services industry, helping businesses navigate complex challenges and capitalize on opportunities for growth and innovation.

Domain experience

Our extensive experience working with financial services customers helps us understand the sector’s specific challenges and complexities, enabling us to develop tailored solutions.

Microsoft Gold partner

As an Microsoft Gold partner and Solution Partner for "Digital and App Innovation" and "Data & AI.", Simform excels in cloud engineering, leveraging it to offer unmatched scalability, flexibility, and security for the financial services industry.

Secure and compliant

At Simform, we prioritize the security of your financial data, implementing stringent measures and ensuring compliance with GDPR, KYC/AML, PCI DSS, and other relevant regulations.

Scalable teams

We are big enough to scale and small enough to care. Our flexible teams grow with you to enable rapid adjustments to project needs, ensuring timely delivery without compromising quality.

Omnichannel experience

We develop solutions that integrate seamlessly across different channels (mobile, web, in-branch) and allow customers to easily switch between channels without disruption.

End-to-end services

We offer full-cycle development services, from initial design to maintenance, leveraging CI/CD, containerization, and DevOps for seamless feedback integration and faster deployments.

Trusted by the World's Leading Companies

Case Studies

Discover the many ways in which our clients have embraced the benefits of the Simform way of engineering.

From Our Experts

Let’s talk

Hiren Dhaduk

Hiren Dhaduk

Creating a tech product roadmap and building scalable apps for your organization.